Can Paypal Keep My Money If Im Under 18

Teaching children to be financially responsible isn't always easy when sites like PayPal ban those under eighteen years quondam from using their services. Thankfully, in that location are many financial alternatives to PayPal, which you can employ to teach kids well-nigh saving and managing money.

Some of the best PayPal alternatives for minors give you "custodial" control, pregnant that you can monitor how your kids are doing and footstep in if you run across them getting into trouble. For starters, consider the following options.

Why Does PayPal Have an Age Limit?

A few years agone, it was possible to set up a PayPal Educatee account, but that service was discontinued.

According to PayPal's website, individuals under 18 years old are not allowed to open an account, regardless of their location:

"If yous are an individual, you must be a resident of one of the countries/regions listed on the PayPal Worldwide page and at to the lowest degree 18 years quondam, or the age of majority in your country/region of residence to open a PayPal business relationship and use the PayPal services."

But PayPal isn't your only option. Feel free to learn how to use PayPal in full, but there are several other banks and financial services that become effectually this age brake past offering teen accounts linked to parental custodial accounts. Some of them are free and require no minimum residuum.

Online Cyberbanking Accounts for Teens

Opening a checking or savings account for your kids can exist a proficient opportunity to teach them nearly budgeting and other aspects of personal finance. Afterwards all, they don't get the chance to learn these things in school.

If they have their own banking concern accounts, they might find it easier to salve for the future and set financial goals. Your children will also learn about the value of maximizing their savings.

Since you lot tin can no longer gear up a PayPal Student account, you'll need to await for alternative options. Ane solution is to open up a custodial account and permit them take buying of it when they turn 18. Meanwhile, yous can proceed an heart on their business relationship activity and help them make sound decisions.

Capital One Money Teen Checking Account

Capital One Money is a nada-fee checking account designed for children and teens ages eight to 18. It requires no minimum balance and includes costless online and mobile banking.

Here'southward what you lot'll go when y'all register for an account:

- No monthly fees.

- A free Mastercard debit carte.

- A articulation account with mobile app login credentials for parents and kids.

- Parental controls.

- Eolith checks with the Majuscule One Mobile app.

- Access to over 70,000 fee-free ATMs across the country.

- Accounts earn interest (0.ten percent annual percentage yield).

An actual bank account puts your teen on the path of understanding how banking works, how interest accumulates as he saves money, and how to manage his finances from calendar month to month.

Since the account includes parental controls, you tin can e'er pace in and assist your teen. In that location is also the pick to transfer money in and out of his account from your own bank account.

Other Online Banking Alternatives

Capital One isn't the merely visitor to get into the teen banking game. A few other banks have stepped up to help out with student cyberbanking accounts.

- Banking concern of America Student Cyberbanking: No monthly maintenance fees (for eligible students), online/mobile banking, nix liability guarantee, and the ability to make mobile check deposits.

- Alliant: Available for kids ages 13 to 17 years one-time, start a joint account for your child with no minimum balance, no monthly fees, online/mobile banking, and involvement rates more than twice that of other teen bank accounts.

- Chase Loftier School Checking: A "high school checking" account is available for students 13- to 17 years old, without a monthly fee if linked to a parent'due south bank account. Chase tends to have ATM and overdraft fees, but this is a proficient opportunity to teach your teen how to avoid such "big bank" fees.

- Huntington Depository financial institution: Children and teens nether 18 years quondam can register for a checking account as long as someone over 18 is willing to open it as a co-signer or as a joining account. Huntington Bank doesn't provide account details online, so make sure to read the fine print when y'all sign upwards.

- Wells Fargo Articulate Access Banking: If your teen is betwixt 13 and 16 years old, you lot can open a checking account in his proper noun. This option requires a $25 minimum eolith and a $5 monthly fee. Account holders tin can make mobile deposits, withdraw cash from over xiii,000 fee-complimentary ATMs nationwide, and pay their bills online. Your teen volition also get a contactless debit carte with nix liability protection.

National banks are not the simply ones offering educatee accounts. Your local bank or credit union may have some options for students as well. Have a look at their website or contact them past phone to see what's available.

Prepaid Debit Cards for Teenagers

A prepaid debit card is one of the all-time PayPal alternatives for minors. With this option, your teen will have admission to a limited amount of coin for daily expenses or emergencies, Plus, yous won't have to get through the hassle of opening a bank account.

You can stop at any pharmacy or supermarket and purchase a refillable prepaid card for your kid to use, one of many means to give money equally a souvenir.

one. American Limited: Bluebird

Bluebird past American Express is a hybrid betwixt a depository financial institution account and a credit card.

The absurd matter well-nigh it is that each "family unit account" includes up to four prepaid cards for other family members. You can apace transfer money to those cards from your central business relationship, set up spending limits, and monitor your teen's account activity.

It'south probably one of the best solutions for parents who desire to dole out allowances to children and get them started learning how to utilize credit cards responsibly.

Download: Bluebird for Android | iOS (Free)

ii. MyVanilla Card

An even simpler solution is to go a Vanilla prepaid bill of fare, which can be found at Walmart and other supermarkets.

Teenagers under eighteen years old can't purchase these cards. However, parents need to buy the card, sign the agreement, and then add the modest as a registered user.

Some features of the MyVanilla Menu include:

- A mobile app to check and manage your business relationship.

- Choose between Visa and Mastercard.

- Make free directly deposits.

- Transfer funds between MyVanilla Card accounts.

- No credit check required.

- Visa cards have zero liability protection for unauthorized transactions.

Note that this service isn't available in Vermont. The standard ATM fee in other states is $1.95 per transaction. If your teen uses the card when traveling away, they'll pay $4.95 per cash withdrawal.

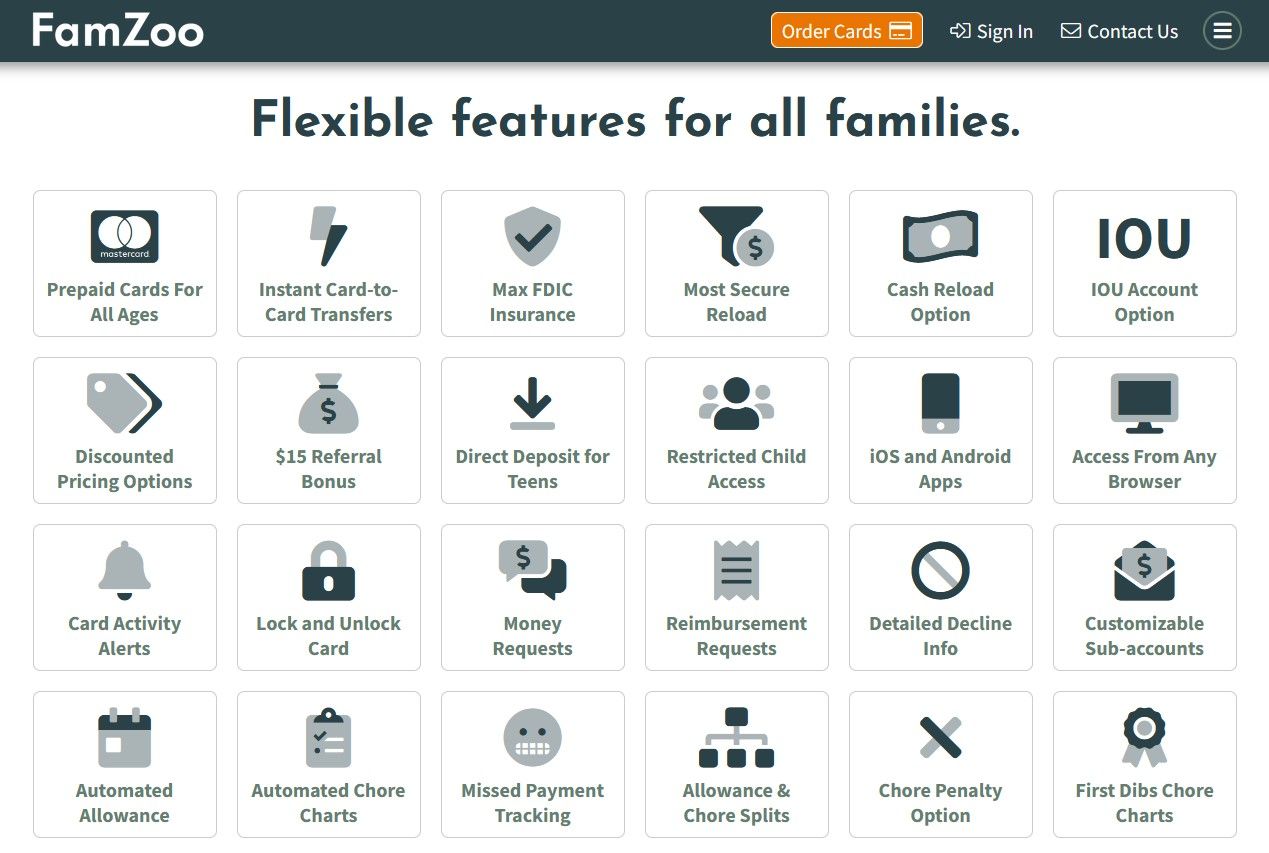

iii. FamZoo Family unit Accounts

One of the easiest ways to manage multiple accounts via a single-family management platform is FamZoo.

This service is like Bluebird on steroids. It offers everything the American Express Bluebird account offers, including a prepaid carte du jour for each child. Withal, what it lacks are most of the fees you'll find when you sign up for a student account with any of the big banks.

The best feature here is automation. You tin gear up assart amounts for each child and and so have the funds automatically transferred to their cards at whatever interval y'all desire.

Users can also gear up savings goals, request money, split payments, and create divide accounts for unlike purposes—all from one platform. For example, y'all could encourage your kids to prepare a savings account and another one for donations.

You tin fifty-fifty connect scheduled chores and jobs to payments or penalties. This is a nifty way to teach kids nigh the human relationship between piece of work and income.

If yous're a really strict parent, y'all can ready "billing", where yous charge your kids for their share of the mobile phone pecker and other expenses!

4. Google Pay

Google Pay (formerly Google Wallet but now combined with Android Pay) is an interesting alternative to PayPal.

It'southward bachelor for any teenager over thirteen as long as a parent provides permission and accepts the terms. Subsequently that, parents can connect a bank or credit bill of fare to the Google Pay account to transfer money into it.

In that location are no bells and whistles. It'due south probably the simplest, nearly inexpensive way to give your kids a place to save and spend their money. Google Pay users can easily split their expenses with friends or family members, transfer coin online, and brand group payments.

You can even save your other credit or debit cards in one place for piece of cake access. The great news is that many retailers nowadays take Google Pay without the need for a credit carte du jour.

Download: Google Pay for Android | iOS (Free)

Education Children Financial Responsibleness

It isn't easy to learn fiscal responsibility. Unfortunately, schools don't teach information technology. And so, information technology's up to parents and families to give kids a solid financial education. Opening a checking or savings business relationship for your kid can be a good starting point.

And if they want to learn more, there are several ways kids can earn money online. This is a neat commencement step toward building adept financial health.

Source: https://www.makeuseof.com/tag/paypal-alternatives-teenagers/

Posted by: hamlinevandood1949.blogspot.com

0 Response to "Can Paypal Keep My Money If Im Under 18"

Post a Comment